Alice Phelan Sullivan Corp. v. United States

United States Court of Claims

381 F.2d 399 (1967)

- Written by Sara Rhee, JD

Facts

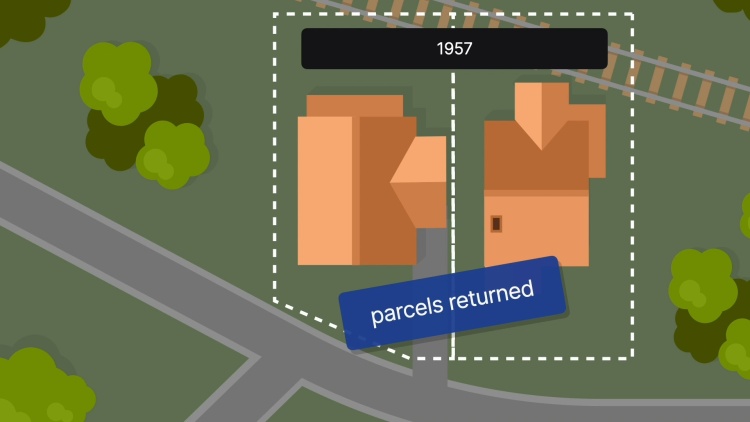

Alice Phelan Sullivan Corp. (corporation) (plaintiff) is a California corporation. In 1939 and 1940, the corporation made donations of two parcels of realty. The corporation took deductions in the amount of $4,243.49 and $4,463.44 for each charitable donation. In 1939, the corporate tax rate was 18 percent. In 1940, it was 24 percent. Under these tax rates, the corporation received a total tax benefit of $1,877.49. In 1957, the donee returned both parcels to the corporation. The corporation did not include the value of the parcels in its gross income for that year. The Commissioner (defendant) determined the two parcels were income equal to the amount of deductions taken in 1939 and 1940, which totaled $8,706.93. The Commissioner applied the 1957 corporate tax rate of 52 percent and assessed a tax of $4,527.60. The corporation paid the tax but filed suit for a refund of $2,650.11, arguing that it should not pay in excess of the tax benefits received in 1939 and 1940.

Rule of Law

Issue

Holding and Reasoning (Collins, J.)

What to do next…

Here's why 905,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 995 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.