Alves v. Commissioner

United States Court of Appeals for the Ninth Circuit

734 F. 2d 478 (1984)

- Written by Sean Carroll, JD

Facts

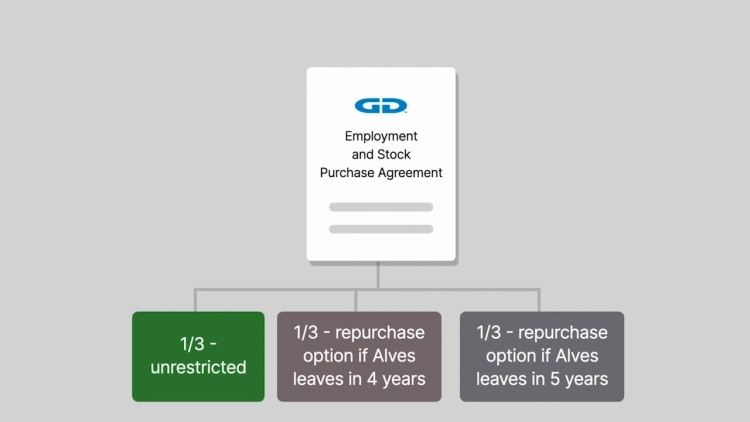

In 1970, General Digital Corporation (GDC) hired Alves (plaintiff). As part of the employment agreement, Alves received a nonqualified stock option. Alves bought 40,000 shares of GDC stock for 10 cents per share. The stocks were divided into three classifications, two of which were restricted in that the company could repurchase the stock if Alves left the company within four or five years, respectively. In 1974 and 1975, the restrictions on Alves remaining stock lapsed. Alves did not report on his 1974 and 1975 income tax returns the stock’s appreciation in value between the time of purchase and the time the restrictions lapsed. The Internal Revenue Service (IRS) (defendant) ruled that Alves’s failure to do so violated section 83 of the Internal Revenue Code. Alves brought suit in federal court. The parties stipulated that 10 cents per share was fair market value for the stock at the time Alves bought it. Nevertheless, the United States Tax Court affirmed the IRS. Alves appealed, arguing that because the purchase price was the same as the fair market value, section 83 should not apply.

Rule of Law

Issue

Holding and Reasoning (Schroeder, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.