Arrowsmith v. Commissioner

United States Supreme Court

344 U.S. 6 (1952), rehearing denied 344 U.S. 900 (1952)

- Written by Sara Rhee, JD

Facts

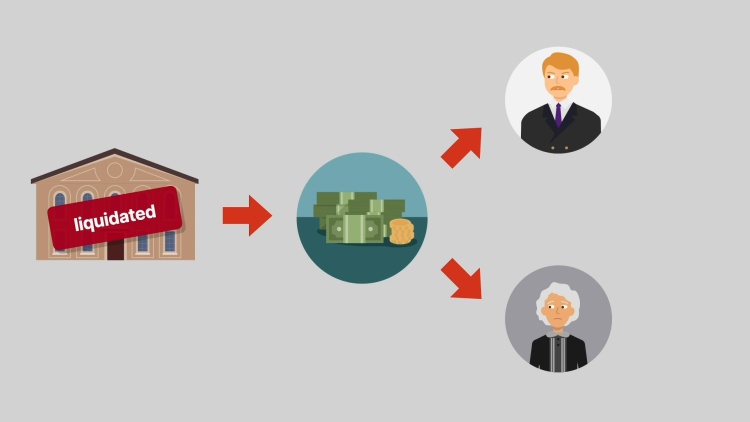

Frederick R. Bauer and another taxpayer (plaintiffs) had equal stock ownership in a corporation. In 1937, the plaintiffs decided to liquidate and divide the proceeds of the corporation. They received distributions of the proceeds in 1937, 1938, and 1939. They received a final distribution in 1940. In their tax returns for each of these years, the plaintiffs properly classified the proceeds as capital gains. In 1944, a judgment was entered against the dissolved corporation and Bauer individually. The plaintiffs, as transferees of the corporation’s assets, were liable to pay the judgment. Each classified the payment in their 1944 tax return as an ordinary loss and deducted the entire amount paid. Had they classified the payment as a capital loss, they would have only been able to deduct a portion of the payment. The Commissioner (defendant) ruled that the payment was related to the liquidation distributions and that the plaintiffs were therefore required to classify the payment as a capital loss. The Tax Court disagreed and classified the payment as an ordinary business loss. The Court of Appeals reversed, classifying the payment as a capital loss. The United States Supreme Court granted certiorari.

Rule of Law

Issue

Holding and Reasoning (Black, J.)

Dissent (Douglas, J.)

Dissent (Jackson, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.