Bayway Refining Co. v. Oxygenated Marketing and Trading A.G.

United States Court of Appeals for the Second Circuit

215 F.3d 219 (2000)

- Written by Mary Pfotenhauer, JD

Facts

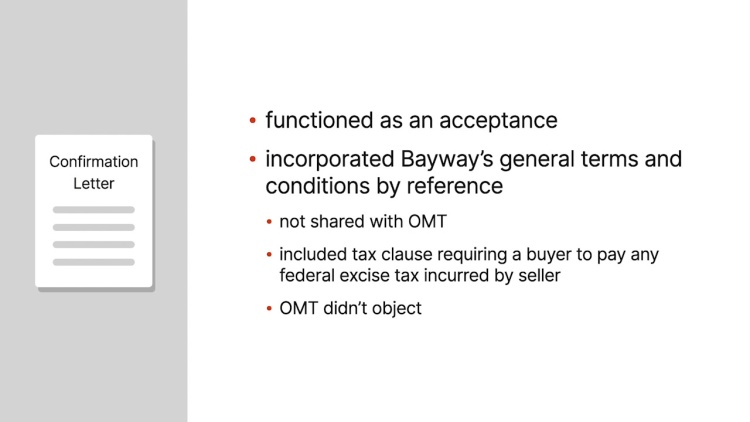

Bayway Refining Company (Bayway) (plaintiff) verbally agreed to sell 60,000 barrels of gasoline to Oxygenated Marketing and Trading A.G. (OMT) (defendant). OMT faxed Bayway a confirmation letter. Bayway faxed its own confirmation letter to OMT, which incorporated by reference Bayway’s general terms and conditions. Those terms and conditions, which were not included in the fax, required a buyer to pay any federal excise tax incurred by the seller (the tax clause). OMT did not object to Bayway’s acceptance or the incorporation of the general terms and conditions. The Internal Revenue Code required a petroleum dealer to pay a federal excise tax on a petroleum transaction if the buyer was not registered for a tax exemption. OMT was not registered for a tax exemption, and Bayway paid the $464,000 tax liability on the sale. When OMT refused to pay Bayway for those taxes, Bayway sued. OMT argued that the tax clause did not become part of the contract, because the tax clause materially altered the contract, and OMT presented evidence that OMT’s executives were surprised by the inclusion of the tax clause. Bayway presented evidence that inclusion of such a clause was the custom and practice in the petroleum industry. The district court granted Bayway’s motion for summary judgment. OMT appealed.

Rule of Law

Issue

Holding and Reasoning (Jacobs, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.