Beneficial National Bank, U.S.A. v. Payton

United States District Court for the Southern District of Mississippi

214 F. Supp. 2d 679 (2001)

- Written by Craig Conway, LLM

Facts

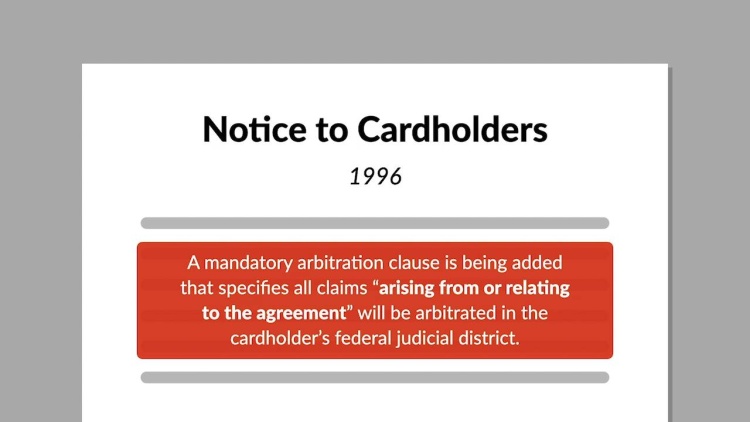

Obie Payton (defendant) signed a revolving credit card application with Beneficial National Bank, U.S.A. (Beneficial) (plaintiff). The application provided that Payton agree to the terms and conditions of the cardholder agreement, including a provision that allowed for subsequent changes to be made to the agreement by Beneficial. Beneficial subsequently notified its cardholders, including Payton, that it was adding a provision requiring mandatory arbitration in the event of any claim, dispute, or controversy unless Payton rejected the change within 30 days. Payton did not notify Beneficial within the time period required. Nearly two years later, Payton’s account with Beneficial was assigned to Household Bank (plaintiff). Cardholders were notified of the assignment by a billing insert which also included a provision requiring mandatory arbitration. Payton filed suit against Beneficial and Household Bank in state court claiming the mandatory arbitration provision was forced upon Payton by fraudulent misrepresentations and other wrongful conduct. Shortly thereafter, Household Bank and Beneficial filed suit in federal court to compel arbitration of Payton’s claims in accordance with § 4 of the Federal Arbitration Act (FAA) as provided for in the cardholder agreement. Payton moved to dismiss the suit for lack of subject matter jurisdiction. Beneficial and Household Bank moved to compel arbitration.

Rule of Law

Issue

Holding and Reasoning (Lee, C.J.)

What to do next…

Here's why 911,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 997 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.