Camps Newfound/Owatonna, Inc. v. Town of Harrison

United States Supreme Court

520 U.S. 564 (1997)

- Written by Sara Rhee, JD

Facts

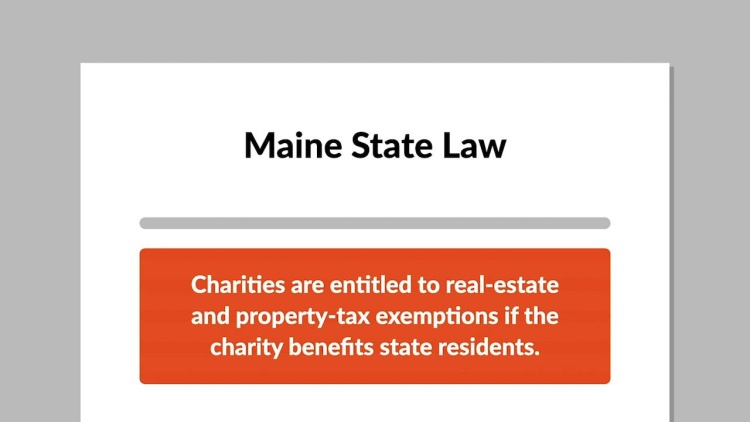

Camps Newfound/Owatonna, Inc. (the camp) (plaintiff) was a Maine nonprofit corporation that operated a summer camp. The camp had not been profitable in recent years. Maine allowed a tax exemption for nonprofit institutions incorporated in the state. However, nonprofit institutions that primarily benefited nonresidents only qualified for a limited tax benefit, if they did not charge more than $30 per person for their services. Ninety-five percent of the camp’s attendees were nonresidents of Maine. Because the camp charged $400 per week for its summer camp, it was not entitled to any tax exemption in Maine. The camp challenged Maine’s tax exemption on the ground that it discriminated against nonresidents in violation of the Dormant Commerce Clause.

Rule of Law

Issue

Holding and Reasoning (Stevens, J.)

Dissent (Scalia, J.)

Dissent (Thomas, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.