Charley v. Commissioner

United States Court of Appeals for the Ninth Circuit

91 F.3d 72 (1996)

- Written by Sara Rhee, JD

Facts

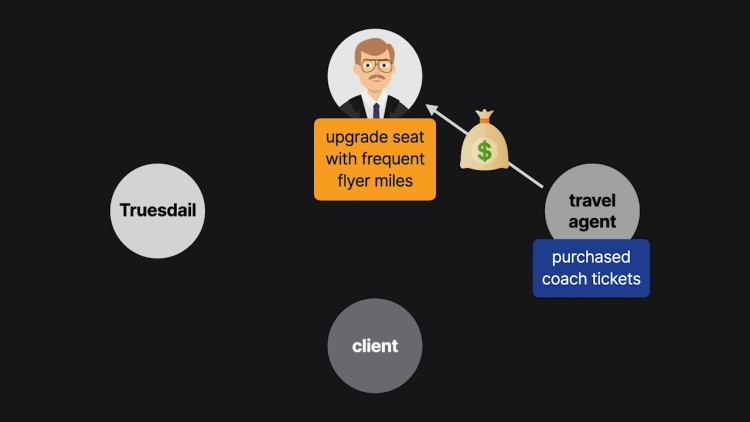

Philip Charley (defendant) served as President of Truesdail Laboratories (Truesdail). Charley frequently traveled for business and accrued many frequent flyer miles. At the time, Truesdail had an unwritten policy that any frequent flyer miles accrued during business travel were the personal property of the employees who accrued them. Throughout 1998, Charley took four business trips. Each time, Truesdail paid its travel agent funds to obtain first class airfare for Charley. But rather than purchasing a first class ticket, Charley instructed the agent to purchase a coach ticket with the funds. Charley would then upgrade the ticket to first class using his frequent flyer miles. The remainder of the original funds from Truesdail (the difference between a first class ticket and a coach ticket) was deposited into Charley’s personal travel account. In this manner, Charley “sold” his frequent flyer miles to Truesdail and received cash in exchange. By the end of the year, Charley had $3,149.93 deposited into his personal travel account. He did not report the amount on his tax return. The Tax Court ruled that the frequent flyer miles were taxable income.

Rule of Law

Issue

Holding and Reasoning (Farris, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.