Commissioner v. Tufts

United States Supreme Court

461 U.S. 300 (1983)

- Written by Sara Rhee, JD

Facts

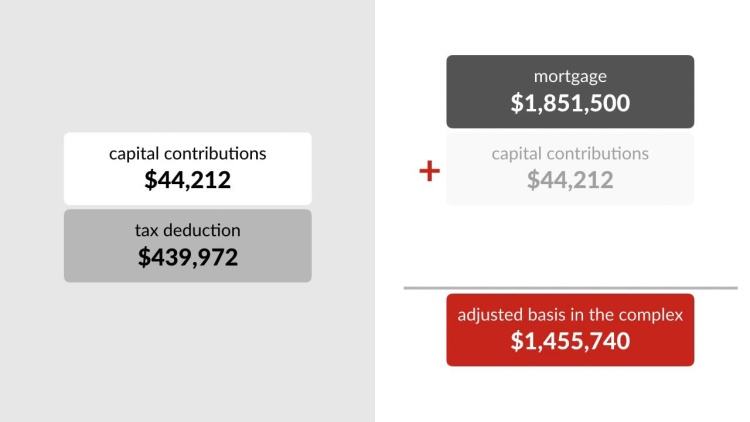

Pelt, Tufts, Steger, Stephens, and Austin (plaintiffs) formed a general partnership for the purpose of building an apartment complex. The partnership obtained a nonrecourse mortgage on the building in the amount of $1,851,500. The complex was completed in 1971, whereupon the partners made capital contributions in the amount of $44,212. In 1971 and 1972, each partner took depreciation deductions totaling $439,972. In light of their capital contributions and depreciation deductions, their adjusted basis in the property in 1972 was $1,455,740. But due to economic problems in the area, the partnership was unable to pay the mortgage. Eventually, each partner sold his share to a third party, who assumed the nonrecourse mortgage. At the time, the fair market value of the property was about $1,400,000. Because the fair market value was lower than their adjusted basis, each partner reported a partnership loss of $55,740 from the sale. But the commissioner (defendant) found the amount realized by the sale included the amount of the unpaid mortgage, even though the mortgage exceeded the fair market value of the building, and determined the partnership had realized a capital gain of about $400,000. The tax court agreed with the commissioner. The court of appeals reversed. The United States Supreme Court granted certiorari.

Rule of Law

Issue

Holding and Reasoning (Blackmun, J.)

Concurrence (O’Connor, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.