Cotton Petroleum Corporation v. New Mexico

United States Supreme Court

490 U.S. 163, 109 S.Ct. 1698, 104 L.Ed.2d.209 (1989)

- Written by Lauren Groth, JD

Facts

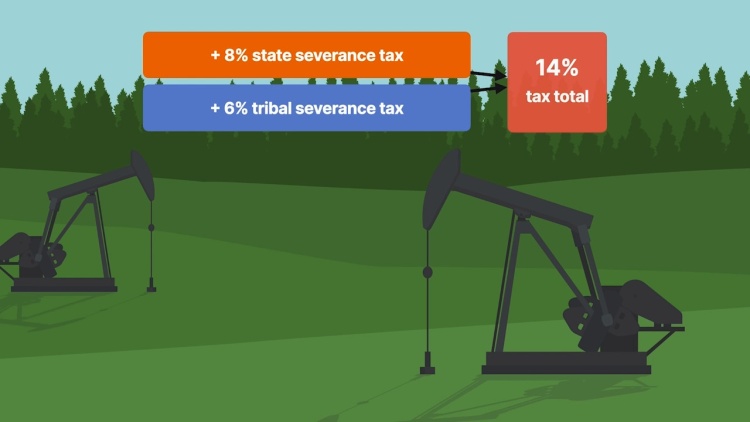

The Jicarilla Apache Tribe in New Mexico operated numerous on-reservation oil and gas leases under the Indian Mineral Leasing Act of 1938 (IMLA), 25 U.S.C. § 396. Cotton Petroleum Corporation (Cotton) (plaintiff) was a non-Indian company that produced oil and gas under a lease with the Apache Tribe. Beginning in 1972, the Apache Tribe assessed an 8 percent tax on the oil and gas extracted by Cotton. This tax was contested but upheld by the United States Supreme Court. The State of New Mexico (defendant) also levied a state tax on oil and gas production extracted on the reservation. Cotton challenged New Mexico’s tax in state court. Cotton argued that New Mexico should not be allowed to tax oil and gas production on an Indian reservation because New Mexico did not expend significant resources to support such production. The Apache Tribe intervened, arguing that imposition of state taxes interfered with tribal taxes on oil and gas and decreased Apache Tribe revenues by discouraging companies from working on the reservation. The New Mexico state courts upheld the state tax. The United States Supreme Court granted certiorari.

Rule of Law

Issue

Holding and Reasoning (Stevens, J.)

Dissent (Blackmun, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.