Estate of Maxwell v. Commissioner

United States Court of Appeals for the Second Circuit

3 F.3d 591 (1993)

- Written by Christine Raino, JD

Facts

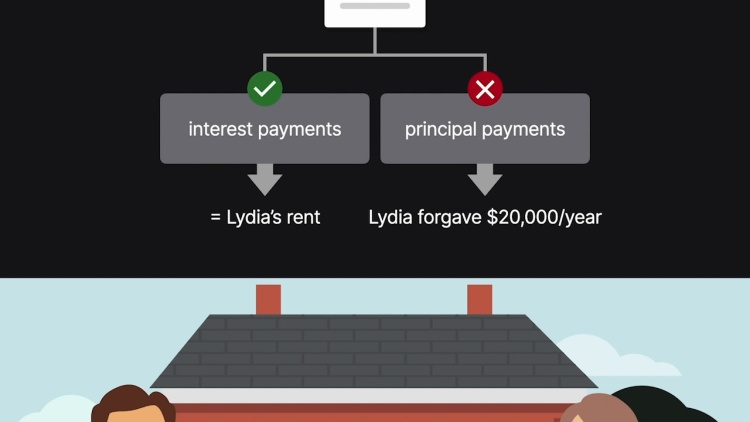

After conveying her residence in 1984 to her son and daughter-in-law, Winslow and Margaret Jane Maxwell (the Maxwells), Lydia G. Maxwell continued to live in her residence until her death in 1986. At the time of the sale, Lydia was eighty-two years old and had cancer. The Maxwells did not reside with Lydia after the purchase but Lydia paid rent to them until her death. The Maxwells paid Lydia $270,000 for the house, of which Lydia agreed to forgive $20,000, an amount equivalent to her maximum annual gift tax exclusion and they executed a mortgage payable to Lydia for the remaining $250,000. Lydia forgave another $20,000 of the mortgage principal the next year, and although the Maxwells paid interest on the mortgage, they made no payments of principal and Lydia’s rent payments were almost equivalent to the amount of the Maxwell’s mortgage interest payments. The $210,000 in mortgage principal remaining when Lydia died was forgiven in her will and the Maxwells sold her house for $550,000 shortly after her death. Lydia’s estate (Estate) (plaintiff) reported the remaining $210,000 on the estate tax return. The Commissioner of Internal Revenue (defendant) ruled that the sale of the residence in 1984 was a sale with a retained life estate subject to estate tax under I.R.C. § 2036(a), and assessed a tax deficiency on Lydia’s estate for the difference between the reported value of $210,000 and the sale price of $550,000. The Estate sought review in the United States Tax Court. In affirming the Commissioner’s ruling, the Tax Court found after a trial on stipulated facts that Lydia transferred her home to the Maxwells with the understanding that she would remain there until she died and that the mortgage would not be paid. Consequently, the court held that the Maxwells did not provide consideration as required under § 2036 to avoid estate tax. The Estate appealed to the United States Court of Appeals for the Second Circuit, asserting that §2036(a) does not apply because the transfer of Lydia’s residence to the Maxwells was “a bona fide sale for an adequate and full consideration” under that provision.

Rule of Law

Issue

Holding and Reasoning (Lasker, J.)

What to do next…

Here's why 911,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 997 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.