Estate of Potter

Florida District Court of Appeal

469 So.2d 957 (1985)

- Written by Mary Pfotenhauer, JD

Facts

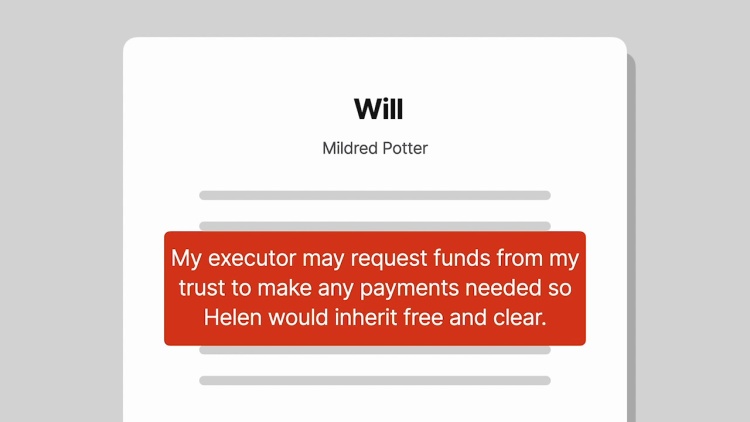

Mildred Potter’s will provided that her residence would pass to her daughter, Helen, upon Potter’s death. Potter also had a trust document, which provided that if her residence passed to Helen under the terms of Potter’s will, then Potter’s son, Edwin, should receive an amount equivalent to the value of the residence out of the trust assets. When Potter died, there were not enough assets in Potter’s trust to pay Edwin an amount equivalent to the value of Potter’s residence. Under Florida common law and § 733.805 of the Florida statutes, an estate’s debts, taxes, and devises will be paid first from funds set aside for those purposes in the will, then from assets that are not disposed of under the will, then from assets that are devised to the residuary beneficiaries of the will, then from general devises, and finally from specific devises. The trial court ordered Potter’s residence to be sold and Potter’s estate to be equally divided between Helen and Edwin.

Rule of Law

Issue

Holding and Reasoning (Walden, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.