Haag v. Commissioner

United States Tax Court

88 T.C. 604 (1987)

- Written by Eric Miller, JD

Facts

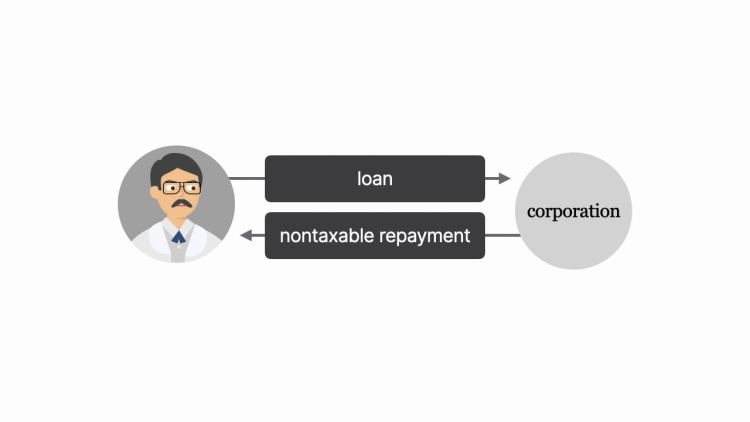

Stanley Haag (plaintiff), a physician, was a general partner in Hilltop Medical Center (Hilltop), a partnership. Haag formed Stanley W. Haag, M.D., P.C. (the P.C.), a professional corporation. Haag, who was the sole director and sole shareholder of the P.C., assigned his interest in Hilltop to the P.C. Hilltop recognized the P.C. as the entity that controlled Haag’s provision of medical services. The P.C. reported its share of Hilltop income on its tax returns, and Haag reported only his salary from the P.C. For 1979, Haag’s income from the P.C. was 45 percent of what it would have been had Haag had not incorporated. For 1980, it was 10 percent. However, for 1981, it was 96 percent. Reasons for the disparities included a series of transactions between Haag and the P.C. that were characterized as loans and nontaxable repayments rather than taxable income. The Commissioner of Internal Revenue Service (the commissioner) (defendant) found deficiencies in Haag’s 1979, 1980, and 1981 tax returns and allocated taxable income to Haag to reflect what Haag’s earnings would have been in the absence of the P.C.’s incorporation. Haag challenged this allocation in federal tax court.

Rule of Law

Issue

Holding and Reasoning (Williams, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.