In re Motors Liquidation Co.

United States Court of Appeals for the Second Circuit

777 F.3d 100 (2015)

- Written by Sean Carroll, JD

Facts

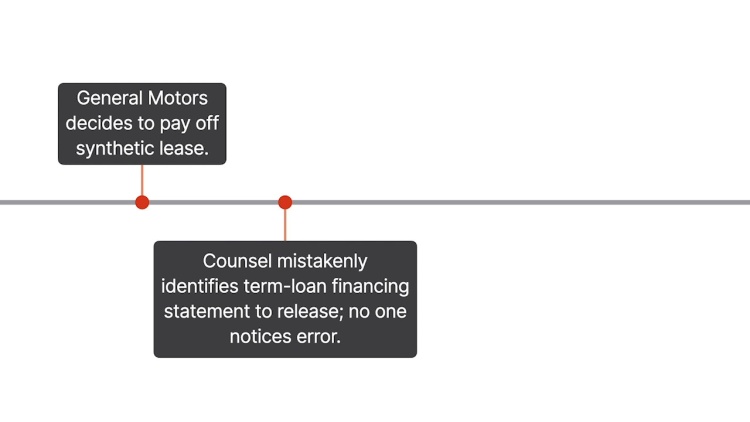

General Motors (GM) entered into two separate financing arrangements. The first financing arrangement was a synthetic lease that provided approximately $300 million from a syndicate of lenders. JPMorgan Chase Bank, N.A. (JPMorgan) (defendant) served as the administrative agent for the lenders on the synthetic lease. This synthetic-lease arrangement gave the lenders a security interest in 12 parcels of real estate. The second financing arrangement was a term loan that provided GM with approximately $1.5 billion from a different syndicate of lenders and included a security interest in a large number of GM’s assets. JPMorgan also served as the administrative agent for the term loan. Eventually, GM arranged to pay off the synthetic lease and hired a law firm, Mayer Brown LLP, to handle the transaction. A paralegal was assigned to determine which Uniform Commercial Code (UCC) filing statements the lenders needed to release in connection with the payoff. The paralegal mistakenly included the primary UCC financing statement for the term loan with the statements for the synthetic lease. Mayer Brown LLP prepared a closing checklist and UCC-3 termination statements that included terminating the term-loan financing statement. JPMorgan and its counsel, Simpson Thacher & Bartlett LLP, approved the documents, and the UCC-3 termination statements were filed. Later, GM filed for bankruptcy. JPMorgan then discovered the mistake and told the Committee of Unsecured Creditors (committee) (plaintiff) that the termination statement for the term-loan financing statement was a mistake and ineffective. The committee filed an adversary action, seeking a declaration that the term-loan termination statement was effective. The bankruptcy court ruled that the termination statement was unauthorized and, therefore, ineffective. The committee appealed to the United States Court of Appeals for the Second Circuit. The Second Circuit then certified a question to the Delaware Supreme Court: must a secured lender intend to terminate a particular security interest in order for an authorized termination statement to be effective? The Delaware Supreme Court answered no, ruling that a termination statement that was properly authorized is effective even if the secured lender did not intend to release a particular security interest.

Rule of Law

Issue

Holding and Reasoning (Per curiam)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.