In re Smith

United States Bankruptcy Court for the Western District of New York

288 B.R. 675 (2003)

- Written by Rose VanHofwegen, JD

Facts

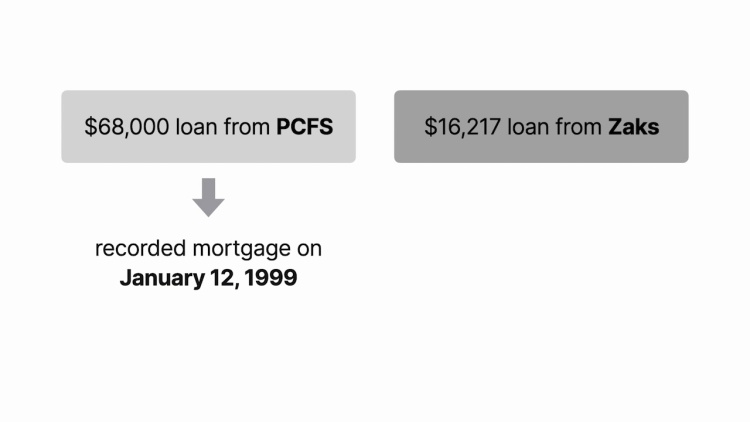

Scott Smith (debtor) bought a home with funds from two sources. The sellers, Robert and Mary Jane Zak (creditors), financed part of the purchase through a purchase-money mortgage. To finance the rest, Smith obtained a mortgage from institutional lender PCFS Mortgage Resources (creditor). PCFS recorded its mortgage first, and the Zaks recorded theirs ten days later. When Smith filed bankruptcy, he owed the Zaks about $15,000 and PCFS about $70,000. But the home’s fair market value as assessed for tax purposes amounted to only $65,606—about $20,000 less than amounts owed on the two mortgages combined. Smith filed a motion to avoid the Zaks’ mortgage, arguing that PCFS’s prior lien completely exceeded Smith’s equity in the home, making the Zaks’ mortgage wholly unsecured and avoidable in bankruptcy. The Zaks countered that a seller’s purchase-money mortgage always takes priority over a third-party lien, regardless of the order recorded.

Rule of Law

Issue

Holding and Reasoning (Bucki, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.