Irwin v. Gavit

United States Supreme Court

268 U.S. 161 (1925)

- Written by Kelsey Libby, JD

Facts

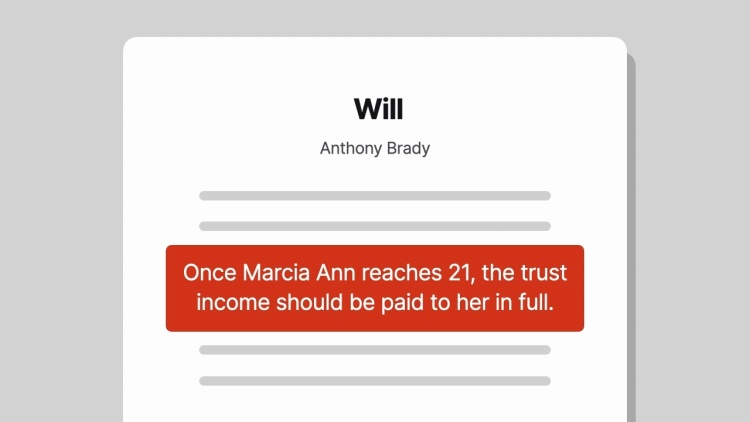

In 1913, the will of Anthony Brady was submitted to probate. In the will, Brady directed that the residue of his estate be held in trust and divided into six equal parts. The income from one part was to benefit Brady’s granddaughter, six-year-old Marcia Ann Gavit, so far as necessary for her education and support. Any remainder of the income from Marcia Ann’s portion was to be divided in half, with one half going to Gavit (plaintiff), Brady’s son-in-law and Marcia Ann’s father, in quarterly payments until Marcia Ann turned 21 years old. Once Marcia Ann reached 21, the fund would turn over to her in full. The collector of internal revenue (defendant) sought to tax the payments to Gavit as income, and this action by Gavit to recover the taxes and penalties followed. The courts below held that the payments were a bequest, not income to Gavit, and the collector appealed.

Rule of Law

Issue

Holding and Reasoning (Holmes, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.