James v. National Financial, LLC

Delaware Court of Chancery

132 A.3d 799 (2016)

- Written by Rose VanHofwegen, JD

Facts

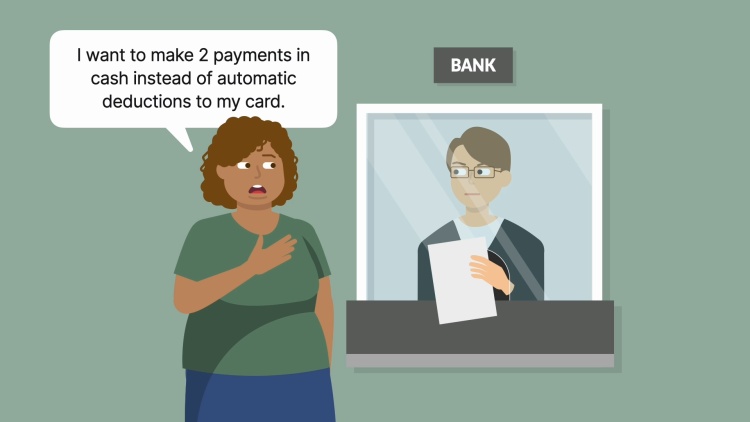

Gloria James (plaintiff) had a GED and worked for low wages. She mistook a student loan she obtained for night school for a grant and had to repay it after dropping out. She had no bank accounts, using a prepaid credit card and high-interest loans to pay for essentials. James borrowed $200 from “Loans Till Payday,” operated by National Financial, LLC (defendant). Delaware had outlawed short-term payday loans, but National simply recast its loans as nonamortizing installment loans that renewed for a longer period. National continued describing its rates as “block” rates, like $30 per $100 borrowed, to make their loans sound cheaper. Employees routinely told customers that the annual percentage rate (APR) meant nothing unless the loan remained outstanding for a year. James focused on the block rate and told a general manager she would repay $130 next payday, then $130 the payday after that. But the loan required 26 $60 interest-only payments, followed by a balloon payment of $200 plus another $60 of interest, stating an APR of 838 percent. The actual APR totaled 1,095 percent, with finance charges totaling $1,620. James broke her hand at work the next day and subsequently missed work for a week, but National refused any accommodations and began collection, calling James’s work and trying to debit her prepaid credit card. After repaying $197, James brought a class action with Truth in Lending Act (TILA) claims, challenging the loan as unconscionable. The trial court refused to certify a class but allowed James’ individual claims to proceed.

Rule of Law

Issue

Holding and Reasoning (Laster, J.)

What to do next…

Here's why 911,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 997 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.