Kenan v. Commissioner

United States Court of Appeals for the Second Circuit

114 F.2d 217 (1940)

- Written by Sara Rhee, JD

Facts

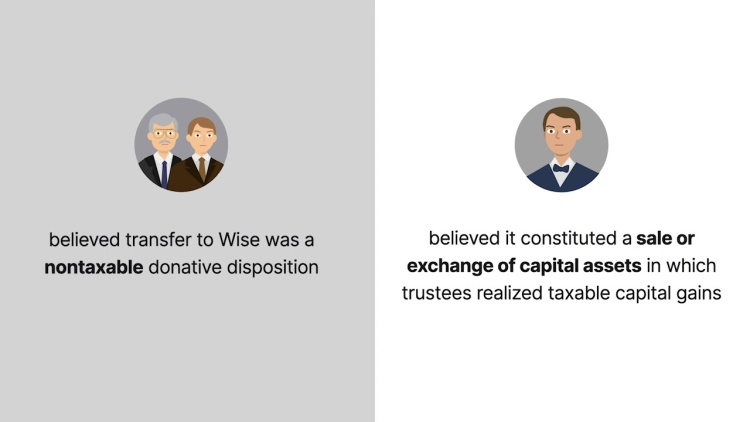

A testator named Bingham, who passed away on July 27, 1917, specified in her will that her residuary estate should be placed in a trust. The trustees (plaintiffs) were to pay income from the trust to Louise Clisby Wise, Bingham’s niece, every year until Wise’s 40th birthday, at which time the trustees were to pay Wise $5,000,000. The will gave the trustees the authority to pay the $5,000,000 in either cash or securities belonging to the trust. Wise turned 40 on July 28, 1935. The trustees paid her in cash and securities. Most of the securities used to pay Wise had been transferred to the trustees as part of Bingham’s residuary estate. The rest had been purchased by the trustees. All the securities had appreciated in value while in the trustee’s possession. As such, the Commissioner (defendant) determined that the trustees had realized taxable income upon disposition of the securities. Because § 117 of the Revenue Act of 1934 limits the percentage of capital gains that can be taxed, the Commissioner only taxed a portion of the trustees’ gain at capital gains rates and found a deficiency of $367,687.12 in the trustees’ income tax for 1935. The Board of Tax Appeals affirmed the Commissioner’s ruling. However, it also denied the Commissioner’s motion before the Board to tax the gain as ordinary income. Because § 117 only limits the percentage of capital gains taxed, the Commissioner sought to tax the trustees’ entire gain at the ordinary income tax rate, resulting in a revised deficiency of $1,238,841.99. The trustees petitioned for review of the Board of Tax Appeal’s ruling. The Commissioner cross-petitioned, asserting the right to tax the trustees’ entire gain at the ordinary income rate.

Rule of Law

Issue

Holding and Reasoning (Hand, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.