Klingbiel v. Commercial Credit Corp.

United States Court of Appeals for the Tenth Circuit

439 F.2d 1303 (1971)

- Written by DeAnna Swearingen, LLM

Facts

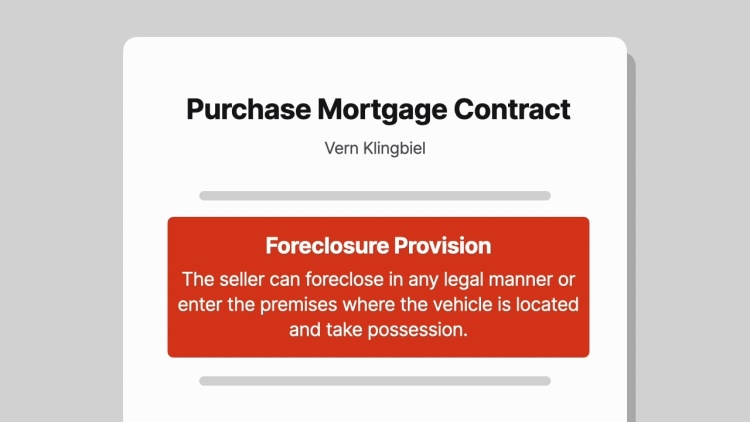

On May 26, 1966, Vern Klingbiel (plaintiff) bought a car from a dealership on credit. Klingbiel made a $400 down payment, and the remaining $4,507.56 balance was to be paid in monthly installments of $125.21 over the course of three years. The mortgage contract provided that if Klingbiel defaulted or the seller “should feel itself insecure,” the seller could accelerate the balance due without notice to Klingbiel. In such an event, Klingbiel would be obligated to pay the balance “upon demand” or redeliver the car. The agreement further gave the seller the right to foreclose in any lawful way or repossess the car without notice or demand to Klingbiel. The car dealer assigned its interest to Commercial Credit Corp. (Commercial) (defendant) for $3,400. Commercial then felt insecure and contracted the Automobile Recovery Bureau of St Louis, Missouri (ARB) to repossess the car. ARB repossessed the car four days before Klingbiel’s first payment was due. Klingbiel sued, and a jury awarded him $770 in actual damages and punitive damages amounting to double the purchase price of the car. Commercial appealed to the United States Court of Appeals for the Tenth Circuit.

Rule of Law

Issue

Holding and Reasoning (Brown, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.