Knetsch v. United States

United States Supreme Court

364 U.S. 361 (1960)

- Written by Robert Taylor, JD

Facts

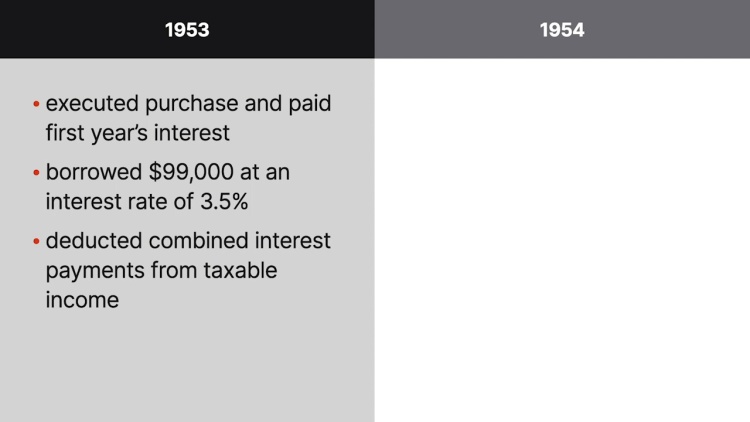

Karl Knetsch (plaintiff) bought deferred annuity bonds from an insurance company to serve as tax shelters. The insurance company loaned Knetsch the funds to purchase the bonds. The insurance company also permitted Knetsch to borrow additional amounts against the bonds as their value increased. Knetsch borrowed substantial funds against the annuity bonds and deducted the interest payments on the loans on his federal tax returns. Because Knetsch borrowed significantly against the annuity bonds’ value, their expected payout upon maturity, when Knetsch would be 90 years old, was negligible. The net result of the annuity bonds on Knetsch’s federal tax liability was that the bonds yielded interest deductions well in excess of Knetsch’s investments in the bonds and had no meaningful financial value beyond the tax deductions. The federal tax commissioner (commissioner) (defendant) disallowed Knetsch’s interest deductions. Knetsch brought an action against the United States government (defendant) in federal district court, seeking a tax refund. The district court determined that Knetsch’s interest payments were a sham, as the annuity-bond transaction had no economic substance, and entered judgment for the commissioner. The court of appeals affirmed. The United States Supreme Court granted certiorari.

Rule of Law

Issue

Holding and Reasoning (Brennan, J.)

Dissent (Douglas, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.