Lynch v. Commissioner

United States Court of Appeals for the Ninth Circuit

801 F.2d 1176 (1986)

- Written by Robert Cane, JD

Facts

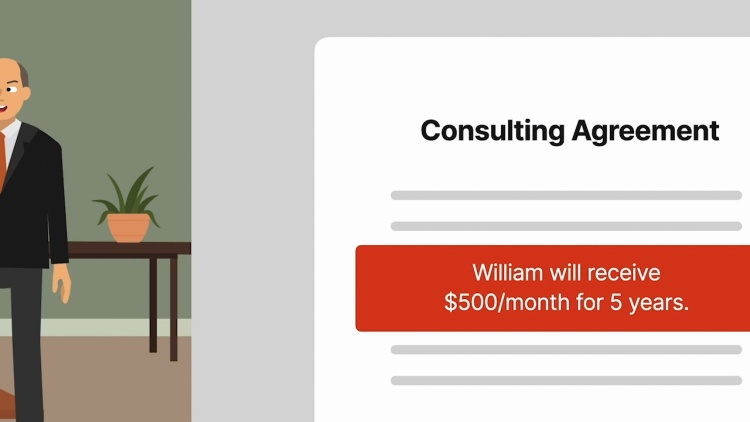

William Lynch (William) (plaintiff) owned all outstanding stock in his corporation, W.M. Lynch Co. At some point, wishing to transfer control and ownership of the company, William sold 50 shares of stock to his son, Gilbert. William resigned in his official roles with the company at the time of this sale. Two weeks after the sale, the corporation redeemed all 2,300 shares of William’s outstanding stock. William received cash and a promissory note in exchange for his stock. On the same day, William entered into a consulting agreement with the corporation because Gilbert wished to retain his father’s technical expertise. The agreement provided William with payments of $500 per month (later reduced to $250) for five years plus reimbursement of expenses. William continued to share his former office with Gilbert. William continued to visit the office daily for one year and after that, once or twice a week. William also remained covered by the corporation’s group medical insurance policy after the redemption. The tax court held that the corporate redemption of the taxpayer’s stock was a sale or exchange subject to capital-gains treatment. The commissioner of the Internal Revenue Service (IRS) (defendant) argued that the taxpayer held a prohibited interest in the corporation after redemption and that the transaction should be taxed as ordinary income as a dividend distribution. The commissioner appealed the tax-court decision to the United States Court of Appeals for the Ninth Circuit.

Rule of Law

Issue

Holding and Reasoning (Hall, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.