Martin v. Peyton

New York Court of Appeals

246 N.Y. 213, 158 N.E. 77 (1927)

- Written by Ronald Quirk, JD

Facts

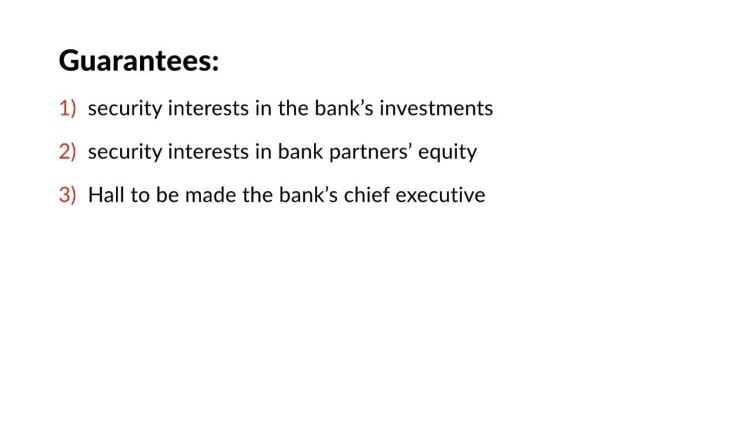

The brokerage firm of Knauth, Nachod & Kuhne (KN&K) made a series of bad investments, which resulted in the firm suffering severe financial difficulties. In order to save KN&K, one of its partners, Hall, entered into a transaction with Peyton (defendant) and other persons (lenders) for a loan of $2,500,000 worth of securities to KN&K. In return for the loan, the lenders were to receive 40 percent of KN&K’s profits until the debt was repaid. The transaction was based on three documents: an agreement, indenture, and option. The agreement provided that: (1) two of the lenders were appointed “trustees” who were to be informed of transactions affecting them, paid dividends and income from those transactions, and had the power to buy and sell their loaned securities and substitute those securities with those of equal value, but could not commingle those securities with KN&K’s other securities and were required to keep the securities valued at a certain level; (2) Hall was given the power of directing the management of KN&K until the loan was repaid, and his life was to be insured for $100,000, with the insurance policies given to the trustees as additional collateral; (3) the trustees were to be kept informed of the important matters of KN&K’s business, could inspect the books, and had the power to veto certain business decisions that could affect their collateral; and (4) each KN&K member was to assign his or her interest in the firm to the trustees, members could receive a loan from KN&K, the members’ draw amount was fixed, and no other distribution of profits could be made. The indenture was basically a mortgage on the collateral delivered by KN&K to the trustees. The option: (1) gave the lenders the opportunity to buy into KN&K by buying 50 percent or less of the members’ interest at a listed price, (2) enabled the formation of a corporation to replace KN&K if its members and lenders agreed, and (3) provided for the resignation of any KN&K member at the demand of Hall. Martin (plaintiff), a creditor of KN&K, sued the lenders, claiming that their transaction with KN&K, as illustrated by the agreement, indenture, and option, made them partners in that firm and thereby liable for KN&K’s debts. The trial court held that the lenders were not partners of KN&K.

Rule of Law

Issue

Holding and Reasoning (Andrews, J. )

What to do next…

Here's why 909,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 997 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.