MidCountry Bank v. Krueger

Minnesota Supreme Court

782 N.W.2d 238 (2010)

- Written by Eric Cervone, LLM

Facts

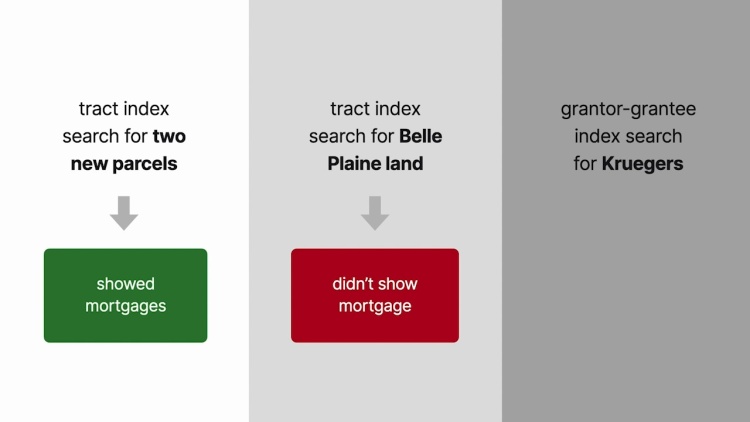

In 2000, Frederick and Nancy Krueger (defendants) purchased a piece of property (the Hinshaw property). Four years later, the Kruegers obtained a loan from MidCountry Bank (plaintiff) to purchase two different parcels of land (the Krueger properties). To secure this loan, the Kruegers executed a mortgage to MidCountry that included both the Krueger properties and the Hinshaw property. The MidCountry mortgage and deed to the Krueger properties were delivered to the country recorder’s office at the same time to be recorded. With one exception, everything about the recording happened correctly. The recorder’s office labeled, numbered, and imaged both the deed and the mortgage correctly. However, there was an issue with the digital indexing of these recorded documents. Minnesota law requires indexing for all recorded documents. When the recorder’s office created the index for the mortgage, the mortgage index only listed the two Krueger properties in the deed as being security for the mortgage. Although the imaged copy of the mortgage in the recorder’s office’s system correctly included the Hinshaw property, the index failed to list the Hinshaw property as being encumbered by the mortgage. The Kruegers later sold the Hinshaw property to Cherolyn Hinshaw, but without any recorded disclosure of the mortgage to MidCountry. Hinshaw executed a mortgage on the property. The Kreugers then defaulted on the MidCountry mortgage. MidCountry sued to foreclose on the Krueger properties and the Hinshaw property. The issue was whether the MidCountry mortgage had been properly recorded. If it had been properly recorded, then Hinshaw had constructive notice of the mortgage when she purchased the property. However, if the mortgage had not been properly recorded, then Hinshaw’s lack of actual or constructive notice of the MidCountry mortgage made her a good faith purchaser with a superior claim to the Hinshaw property. The trial court held that the MidCountry mortgage was not properly recorded and granted summary judgment in favor of Hinshaw. MidCountry appealed. The appeals court reversed, concluding that the MidCountry mortgage was properly recorded. Hinshaw appealed to the Supreme Court of Minnesota.

Rule of Law

Issue

Holding and Reasoning (Anderson, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.