Mitchell v. Texas Gulf Sulphur Co.

United States Court of Appeals for the Tenth Circuit

446 F.2d 90 (1971)

- Written by Jose Espejo , JD

Facts

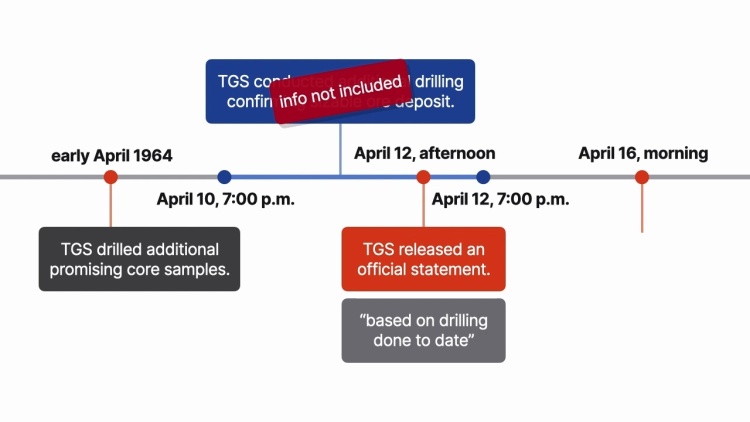

George Reynolds, Walter Mitchell, and Arthur Stout (plaintiffs) were stockholders in Texas Gulf Sulphur Co. (TGS) (defendant). In November 1963, TGS core-drilled an anomaly on a plot of land known as K-55-1; the core-drilling was completed on November 12. On November 14, TGS’s chief geologist advised that the minerals were ore grade but cautioned about extrapolating the results of the core-drilling. At this point, TGS only owned a small portion of K-55-1. In March 1964, TGS obtained all the interests in the adjacent drill sites. By April 10, some of the K-55 sites drilled were found to be comparable to the original K-55-1 site. Between 7:00 p.m. on April 10 and April 12, more information was released regarding the extrapolation of the Timmins drill site, one of the new K-55 drill sites. By the morning of April 13, TGS was trying to suppress information they received regarding the increased copper found at the Timmins drill site. On April 11, the New York Times and the Herald Tribune printed stories on the strike. TGS also prepared an official response containing information from the 7:00 p.m. April 10 data, which did not show the increased copper found; the response was released on April 12. On April 16, an article was released to the media with permission from TGS that the Timmins drill site was successful regarding cooper. Following this, Reynolds, Mitchell, and Stout sued TGS, to recover damages for failing to disclose the information about the copper on April 12 and prior to April 16, 1964. Reynolds, Mitchell, and Stout argued that after the release of the April 12 notice, they sold their stocks to avoid losing their stock value. However, had Reynolds, Mitchell, and Stout kept their stocks, they would have doubled their holdings. The trial court held that the April 12 press release was false, misleading, deceptive, and fraudulent, that TGS knew about the increased cooper, and that TGS should have known stockholders would react based on the April 12 press release. Regarding damages, the trial court awarded damages to the plaintiffs reflecting the highest stock price within 20 trading dates. Reynolds, Mitchell, and Stout appealed, arguing that they should get restitution—because TGS was unjustly enriched by released false media reports—or damages, and TGS appealed, arguing that Reynolds, Mitchell, and Stout should get the April 16 price of the stock.

Rule of Law

Issue

Holding and Reasoning (Hill, J.)

What to do next…

Here's why 910,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 997 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.