Morsman v. Commissioner

United States Court of Appeals for the Eighth Circuit

90 F.2d 18 (1937)

- Written by Sean Carroll, JD

Facts

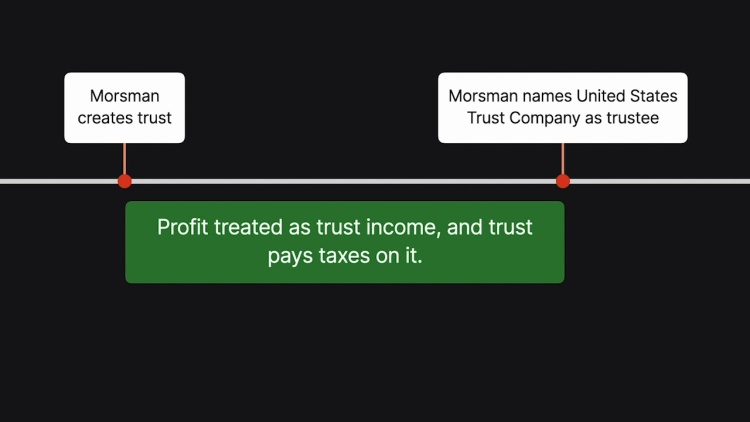

Robert Morsman (plaintiff) executed a trust agreement naming himself trustee of certain stocks that he owned. At the time, Morsman was not married and had no children, but he had a living brother. The trust agreement stated that the trust was to terminate upon Morsman’s death if he did not have any children. The trust stated that if Morsman did have children at the time of his death, the children would receive income from the stocks for 20 years, at which point the trust would terminate and the principal would go to Morsman’s children, his widow, or his heirs. In 1929, Morsman sold some of the stock, making a profit. Morsman did not report the income on his personal tax return. The commissioner of the Internal Revenue Service (IRS) (defendant) ruled that Morsman should have reported the income as his individual income. The board of tax appeals affirmed. Morsman filed suit, arguing that the income was not his but belonged to the trust.

Rule of Law

Issue

Holding and Reasoning (Thomas, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.