Morton Frank v. Commissioner

United States Tax Court

20 T.C. 511 (1953)

- Written by Sara Rhee, JD

Facts

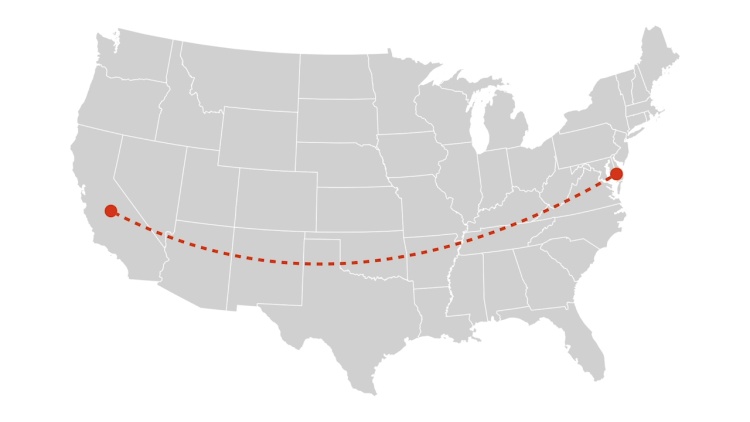

Morton Frank and Agnes Dodds Frank (plaintiffs) were husband and wife. The Franks were interested in purchasing and operating a newspaper or radio station. At the end of November 1945, they left for a trip throughout the United States in an effort to find potential newspapers or radio stations to purchase. In November 1946, they purchased a newspaper in Ohio. Until they made the purchase, the Franks incurred significant travel, communication, and legal expenses. The Franks deducted $5,965 of these expenditures as ordinary and necessary business expenses.

Rule of Law

Issue

Holding and Reasoning (Van Fossan, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.