Orrisch v. Commissioner

United States Tax Court

55 T.C. 395 (1970)

- Written by Rose VanHofwegen, JD

Facts

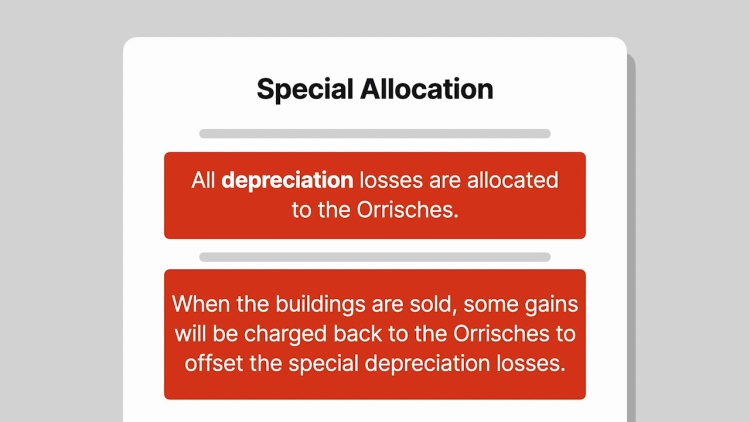

Stanley and Gerta Orrisch (plaintiffs) formed a partnership with Domonick and Elaine Crisafi to buy two apartment buildings financed primarily with secured loans. In addition, the Orrisches contributed $35,000 and the Crisafis $21,300. The couples orally agreed to share profits and losses equally. During the first three years, the partnership realized ordinary losses from taking accelerated-depreciation deductions. The Orrisches used their share to offset income realized from other businesses, but the Crisafis had large losses from other investments and no taxable income, so they could not use their share. The fourth year, the partners allocated all the deductions to the Orrisches but deducted them from their capital account and agreed that attributable gains would be charged back to the Orrisches if the couples sold the buildings. After two years the Orrisches’ capital account had a deficit over $25,000, whereas the Crisafis’ capital account retained a $406 balance. The Internal Revenue Service (IRS) disregarded the special allocation as made primarily to avoid taxable income. Meanwhile, the Orrisches’ marital-property-settlement agreement the next year also allocated all depreciation deductions on jointly owned real estate to Stanley, with chargebacks when the properties sold. The Orrisches petitioned the tax court for review.

Rule of Law

Issue

Holding and Reasoning (Featherston, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.