Peracchi v. Commissioner

United States Court of Appeals for the Ninth Circuit

143 F.3d 487 (1998)

- Written by Robert Cane, JD

Facts

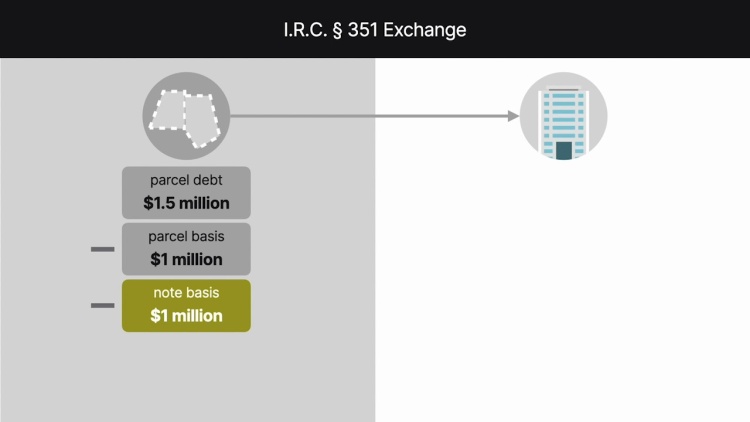

Donald Peracchi (plaintiff) contributed two parcels of real estate to his closely held corporation (NAC). The parcels were encumbered with liabilities $500,000 greater than Peracchi’s total basis in the properties. Thus, the transfer would trigger § 357(c) of the Internal Revenue Code (I.R.C.), and Peracchi would have to recognize an immediate gain on the transaction because the liabilities exceeded the basis in the properties. To avoid triggering I.R.C. § 357(c), which would require him to pay taxes on a $500,000 gain immediately, Peracchi executed a promissory note with a face value of about $1 million and contributed it to NAC along with the two encumbered parcels. Peracchi had adequate assets to be considered creditworthy for purposes of the promissory note. The commissioner of the Internal Revenue Service (IRS) (defendant) declined to treat the promissory note as a genuine debt that increased Peracchi’s basis in the property contributed to NAC. The tax court found in favor of the commissioner. Peracchi appealed to the United States Court of Appeals for the Ninth Circuit.

Rule of Law

Issue

Holding and Reasoning (Kozinski, J.)

Dissent (Fernandez, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.