Perez v. Commissioner

United States Tax Court

144 T.C. 51 (2015)

- Written by Sean Carroll, JD

Facts

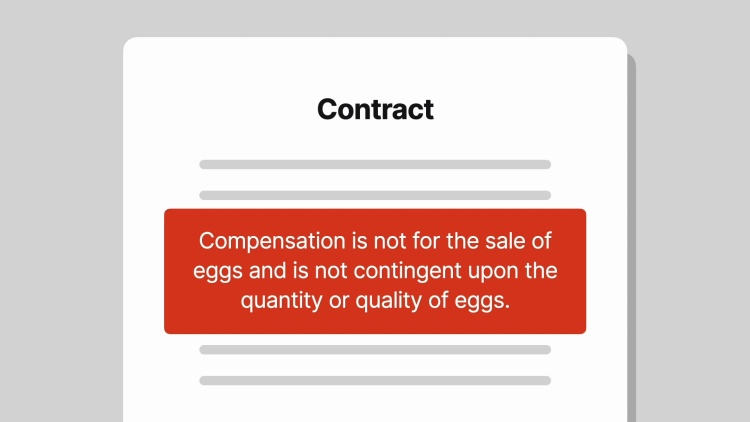

Nichelle Perez signed a contract with Donor Source International LLC, an egg donation clinic. Under the contract, Donor Source injected Perez with several rounds of hormones, and Donor Source surgically extracted Perez’s eggs. In exchange, Perez received $10,000 for her pain and suffering through the process. The contract stated that the compensation was not for the sale of Perez’s eggs. Further, the compensation was not based on the quantity or quality of the eggs. Even if the process resulted in no eggs, Perez still would have been paid. Perez repeated the process later that year for an additional $10,000. Perez, believing that the compensation was not taxable, did not report it in her federal income tax return. The Internal Revenue Service sent Perez a deficiency notice, claiming that the $20,000 was taxable. Perez filed a petition in United States Tax Court claiming that the compensation was not taxable income.

Rule of Law

Issue

Holding and Reasoning (Holmes, J.)

What to do next…

Here's why 899,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,000 briefs, keyed to 994 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.