Salvatore v. Commissioner

United States Tax Court

T.C. Memo 1970-30 (1970)

- Written by Sara Rhee, JD

Facts

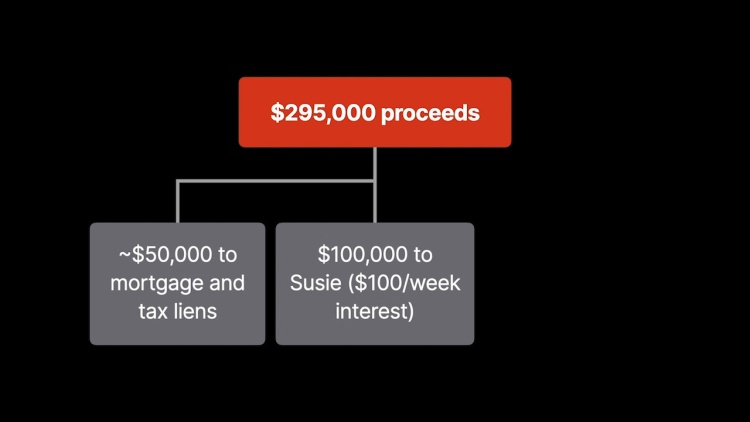

In 1948, Susie Salvatore (plaintiff) inherited her husband’s gas-station business. Salvatore’s children operated the gas station and kept most of the proceeds, but Salvatore received enough of the proceeds to cover her living expenses. By 1963, only one of the children, Amedeo, still worked at the gas station. Amedeo opened negotiations to sell the gas-station property (property) to Texaco, Inc. (Texaco). In July 1963, Texaco offered Amedeo $295,000 to buy the property. Later that month, Salvatore accepted Texaco’s offer. The family agreed that Salvatore and her children would divide the sale proceeds, with Salvatore’s share based on the family’s estimate that Salvatore needed $100,000 to support her for the rest of her life. The family also agreed that Salvatore, without consideration, would transfer one-half of her interest in the property to her children. Salvatore made this half-interest transfer in August 1963. The sale was completed in September 1963, when Salvatore and her children each transferred their interests in the property to Texaco. Salvatore received one-half of the net sale proceeds, and the children divided the other half. On her 1963 federal income-tax return, Salvatore reported her half of the sale proceeds as a capital gain. The commissioner of internal revenue (commissioner) (defendant) determined that all of the sale proceeds were taxable as Salvatore’s capital gain. Salvatore petitioned the tax court for a redetermination.

Rule of Law

Issue

Holding and Reasoning (Featherston, J.)

What to do next…

Here's why 911,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 997 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.