Sharp v. United States

United States District Court for the District of Delaware

199 F. Supp. 743 (1961) affirmed 303 F.2d 783 (1962)

- Written by Sara Rhee, JD

Facts

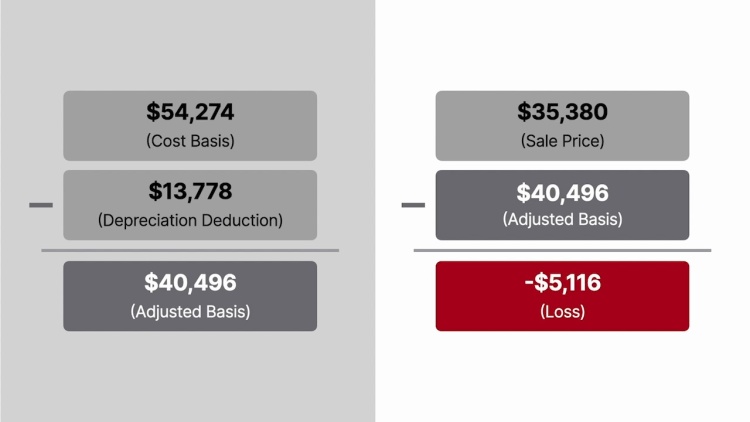

Hugh R. Sharp, Jr. and Bayard Sharp (plaintiffs) formed a partnership. In 1946, their partnership purchased an airplane. The total cost of the plane was $54,273.50. The plaintiffs calculated that, over the years, they had used the plane 73.654 percent for personal use and 26.346 percent for business purposes. They determined that they were allowed up to $14,298.90 in depreciation deductions, the equivalent of 26.346 percent of the cost of the plane. During their ownership, the plaintiffs actually claimed depreciation deductions in the amount of $13,777.92. They sold the plane in 1954 for $35,380. The plaintiffs did not report a gain on the sale of the airplane. The government (defendant) determined that the plaintiffs gained $8,800.23 from the sale. The plaintiffs brought suit to recover the amount of tax assessed against them. Both parties moved for summary judgment.

Rule of Law

Issue

Holding and Reasoning (Layton, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.