TransUnion LLC v. Ramirez

United States Supreme Court

141 S.Ct. 2190 (2021)

- Written by Robert Cane, JD

Facts

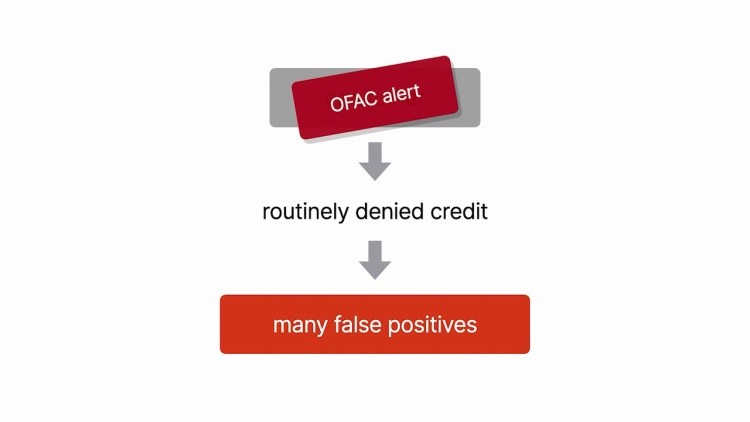

The Fair Credit Reporting Act (the act) required credit-reporting agencies to follow reasonable procedures to ensure maximum possible accuracy of reports. The act provided a cause of action to consumers to recover damages from any person who willfully failed to comply with the act’s requirements. TransUnion LLC (defendant) was a credit-reporting agency. In 2002, TransUnion introduced its Office of Foreign Assets Control Name Screen Alert (OFAC alert) product. When TransUnion conducted a credit check, it checked a consumer’s name against a list of persons deemed to be national-security threats. If a consumer’s name matched a name on the threat list, an OFAC alert went in the consumer’s file, indicating the consumer as a potential threat. This system generated numerous false positives. Consumers who had OFAC alerts in their credit reports were denied credit. Sergio Ramirez (plaintiff) sought to buy a new car with his wife. However, TransUnion had mistakenly placed an OFAC alert on Ramirez’s credit report. After the car dealer received Ramirez’s credit report from TransUnion, the dealer refused to sell to Ramirez because his report had an OFAC alert. Consequently, Ramirez’s wife purchased the car in her name. Ramirez then requested and received a copy of his credit file from TransUnion. Ramirez also received a letter regarding his OFAC alert. Ramirez sued TransUnion under the act for failing to use reasonable procedures to ensure maximum possible accuracy in its credit reports. Ramirez sought to certify a class of plaintiffs comprising all people who received a mailing indicating that an OFAC alert was attached to their credit files between January 1 and July 26, 2011. The district court granted the class certification. TransUnion and Ramirez stipulated that the class contained 8,185 members (the number of people who received a letter regarding an OFAC alert). The parties also stipulated that 1,853 class members had their credit reports sent to potential creditors between January and July of 2011. The district court ruled that all class members had Article III standing. The jury returned a verdict for the entire class. The court of appeals affirmed. TransUnion appealed.

Rule of Law

Issue

Holding and Reasoning (Kavanaugh, J.)

Dissent (Thomas, J.)

What to do next…

Here's why 911,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 997 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.