Minneapolis Star & Tribune Co. v. Minnesota Commissioner of Revenue

United States Supreme Court

460 U.S. 575, 103 S.Ct. 1365, 75 L.Ed.2d 295 (1983)

- Written by Megan Petersen, JD

Facts

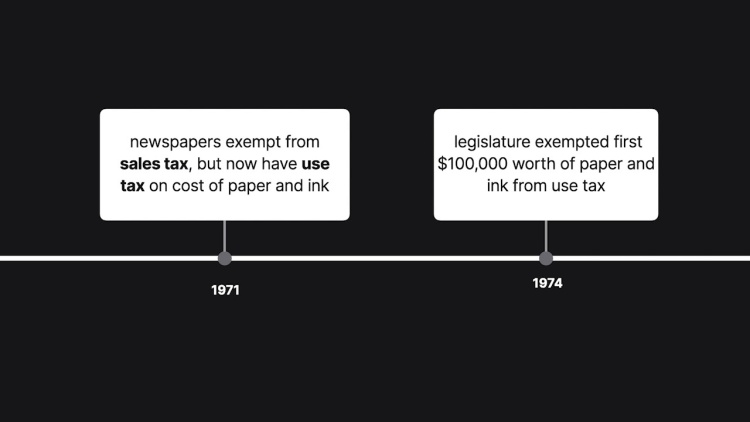

In 1967, the Minnesota Commissioner of Revenue (defendant) imposed a sales tax on most sales of goods. The Minneapolis Star & Tribune Co. (plaintiff) publishes a morning and evening newspaper in Minneapolis, Minnesota. From 1967 to 1971, it enjoyed an exemption from the sales and use tax provided for Minnesota publications. In 1971, the Minnesota legislature amended its tax scheme to impose a “use tax” on the cost of paper and ink products consumer in production of a publication. The scheme was later amended to exempt the first $100,000 worth of ink and paper consumed in a calendar year. After this exemption was enacted, eleven publishers produced enough paper to incur a tax liability. Minneapolis Star & Tribune Co. (Star Tribune) (plaintiff) was one of the eleven, and paid almost two-thirds of the total revenue raised by the tax. The following year, the Star & Tribune again bore roughly two-thirds of the total receipts from the use tax on ink and paper. The Star & Tribune sued the Minnesota Commissioner of Revenue (defendant) and alleged that the tax improperly burdened its freedom of press. The Minnesota Supreme Court upheld the tax as constitutional. The Star & Tribune appealed to the United States Supreme Court.

Rule of Law

Issue

Holding and Reasoning (O’Connor, J.)

Dissent (Rehnquist, J.)

What to do next…

Here's why 911,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 997 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.