Regan v. Taxation With Representation

United States Supreme Court

461 U.S. 540 (1983)

- Written by Sean Carroll, JD

Facts

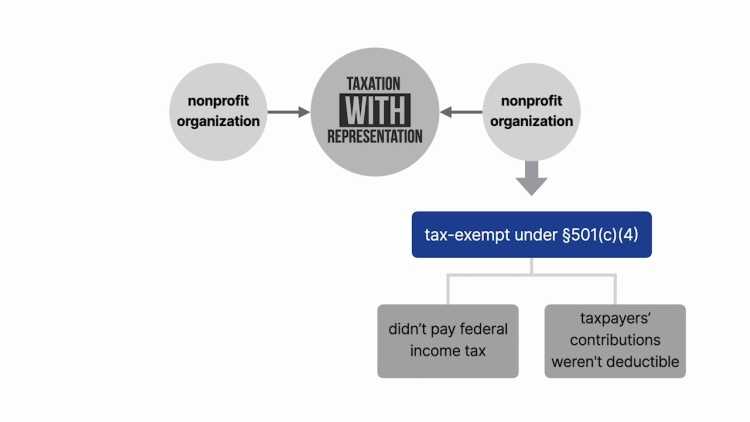

Taxation With Representation (TWR) (plaintiff) was a nonprofit organization that applied for tax-exempt status under 26 U.S.C. §501(c)(3). That status was important because it not only made an organization tax-exempt, but also made charitable contributions to the organization tax-deductible for the donor. But §501(c)(3) organizations could not engage in substantial efforts to influence legislation. Because TWR intended to advocate its message using various methods, including lobbying, its application was denied. If a nonprofit was precluded from §501(c)(3) status because of lobbying, it could still be tax-exempt under §501(c)(4) but charitable contributions would not be deductible. Wanting to be able to use tax-deductible contributions to fund all of its activities, TWR brought suit against the secretary of the treasury (defendant), claiming that §501(c)(3)’s prohibition on lobbying violated the First Amendment. The district court ruled in favor of the secretary, and the appellate court reversed. The United States Supreme Court granted certiorari.

Rule of Law

Issue

Holding and Reasoning (Rehnquist, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.