Till v. SCS Credit Corporation

United States Supreme Court

541 U.S. 465 (2004)

- Written by Denise McGimsey, JD

Facts

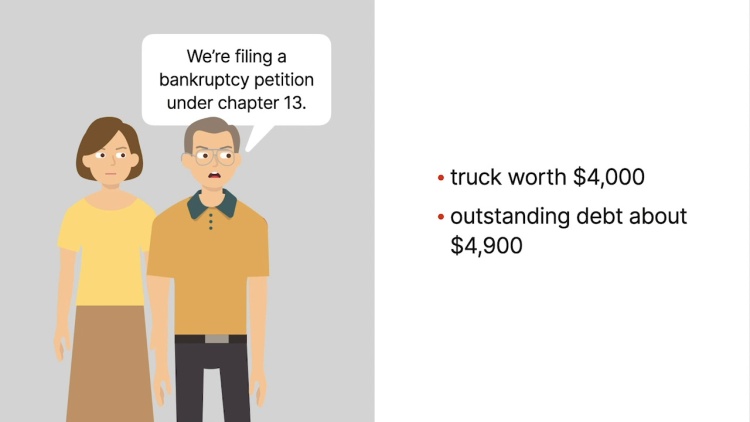

Lee and Amy Till (defendants) filed a Chapter 13 bankruptcy petition. In exchange for a loan to buy a used truck, they were in debt to SCS Credit Corporation (SCS) (plaintiff), with the debt subject to a 21 percent annual finance charge. At the time of their bankruptcy filing, the Tills owed SCS $4,894.89 but the truck was worth only $4,000, leaving $894.89 unsecured. The Tills proposed a repayment plan in which a portion of their future earnings—assigned to the bankruptcy trustee on a monthly basis—would be directed to paying creditors over three years. The plan also provided that SCS would receive interest of 9.5 percent per year on the secured portion of its claim. This “formula” interest rate was composed of the national prime rate of eight percent plus an upward adjustment of 1.5 percent to account for the risk of nonpayment by debtors in the Tills’ position. SCS objected, arguing that the appropriate interest rate was the 21 percent that it uniformly applied to subprime loans. The bankruptcy court ruled in favor of the Tills. The district court reversed, holding that the 21 percent rate was required. The Court of Appeals for the Seventh Circuit essentially agreed with the district court but with a modification. It endorsed the parties’ contract rate as the presumptively appropriate interest rate, subject to rebuttal by either creditor or debtor. The Tills petitioned the Supreme Court for certiorari.

Rule of Law

Issue

Holding and Reasoning (Stevens, J.)

Concurrence (Thomas, J.)

Dissent (Scalia, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.