Williams v. McGowan

United States Court of Appeals for the Second Circuit

152 F.2d 570 (1945)

- Written by Sara Rhee, JD

Facts

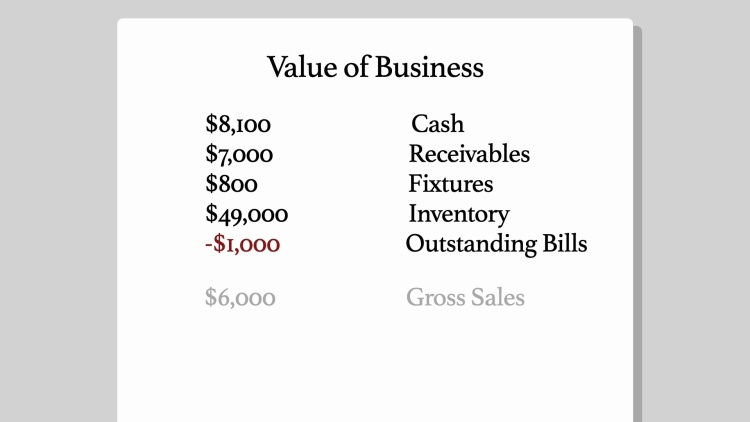

Williams (plaintiff) formed a hardware business with Reynolds in 1926. Williams had a two-thirds interest in the company and Reynolds had a one-third interest. Williams and Reynolds granted each other the privilege of purchasing each other’s interest in the business if and when one of them withdrew. They ran the business together until Reynolds’ death in 1940. Williams purchased Reynolds’ interest in the business from Reynolds’ executrix for $12,187.90. Later that year, Williams sold the business for the value of the business in addition to $6,000. Around the time of sale, the business’ value included about $8,100 in cash, $7,000 in receivables, $800 in fixtures, and $49,000 in merchandise inventory, minus $1,000 for bills payable. The business’ total value amounted to about $63,926.28. Williams sustained a loss upon the sale of his original two-thirds interest and realized a small gain upon the sale of Reynolds’ one-third interest. He reported both items as ordinary income rather than as capital assets. The Commissioner disallowed treatment of the items as ordinary income. Williams paid income tax accordingly and then brought suit to recover the amount overpaid. The trial court dismissed Williams’ complaint.

Rule of Law

Issue

Holding and Reasoning (Hand, J.)

Dissent (Frank, J.)

What to do next…

Here's why 911,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 997 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.