Ackerberg v. Johnson

United States Court of Appeals for the Eighth Circuit

892 F.2d 1328 (1989)

- Written by Eric Maddox, JD

Facts

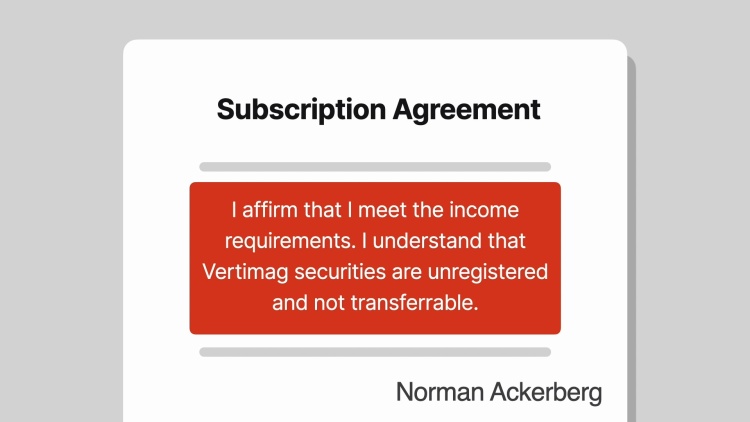

In 1984, Norman Ackerberg (plaintiff) bought shares of stock in Vertimag Systems Corporation (Vertimag) from Clark Johnson (defendant). Prior to selling the stock, Johnson had owned the securities for at least four years. Piper, Jaffray & Hopwood, Inc. (PJH) (defendant), a brokerage firm, gave Ackerberg a memoranda containing information about Vertimag. Subsequently, Ackerberg signed a subscription agreement in which Ackerberg affirmed that his income met certain requirements and that he understood the Vertimag securities were unregistered and not transferable. Later, Ackerberg brought suit against Johnson and PJH for violating the Securities Act of 1933 (the 1933 Act) and other securities laws. The district court granted summary judgment in favor of Ackerberg and found that Johnson was not entitled to an exemption under § 4[(a)](1) of the 1933 Act. Johnson appealed, arguing that he was entitled to an exemption, because he was not, as Ackerberg contended, an underwriter.

Rule of Law

Issue

Holding and Reasoning (Beam, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.