Lorenzo v. Securities and Exchange Commission

United States Supreme Court

139 S. Ct. 1094 (2019)

- Written by Rose VanHofwegen, JD

Facts

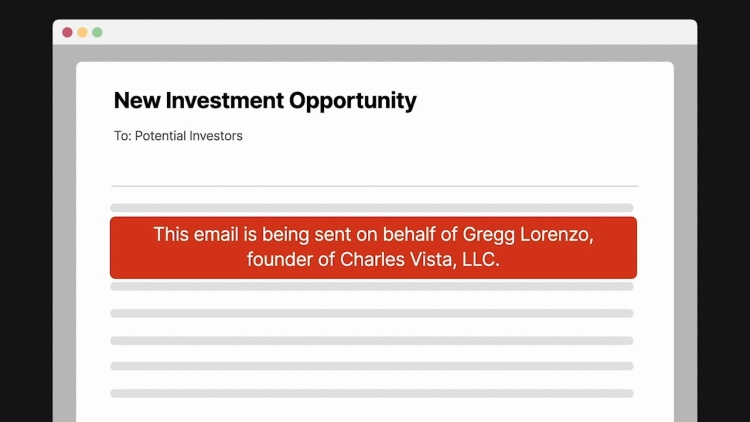

Francis Lorenzo (defendant) worked for a broker-dealer firm as the director of investment banking. Lorenzo knowingly sent emails containing false statements about investment opportunities to two clients. Lorenzo’s boss, who owned the firm, wrote the emails and told Lorenzo to send them. Lorenzo added a caption explaining that the owner had asked Lorenzo to send the emails and signed them with a note asking the clients to call him with any questions. The Securities and Exchange Commission (SEC) (plaintiff) found that Lorenzo violated Rule 10b-5, § 17(a) of the 1933 Securities Act and § 10b of the 1934 Securities Act. Lorenzo appealed, arguing that he should hold only secondary liability for disseminating false statements, instead of the same primary liability as a person who makes false statements. The appellate court affirmed that even though Lorenzo did not make the statements himself, Lorenzo directly violated other Rule 10b-5 fraud prohibitions. Lorenzo did not challenge the appellate court’s finding that he knew the statements were false but appealed to the Supreme Court, arguing that he had no primary liability under Rule 10b-5.

Rule of Law

Issue

Holding and Reasoning (Breyer, J.)

Dissent (Thomas, J.)

What to do next…

Here's why 907,000 law students have relied on our case briefs:

- Written by law professors and practitioners, not other law students. 47,100 briefs, keyed to 996 casebooks. Top-notch customer support.

- The right amount of information, includes the facts, issues, rule of law, holding and reasoning, and any concurrences and dissents.

- Access in your classes, works on your mobile and tablet. Massive library of related video lessons and high quality multiple-choice questions.

- Easy to use, uniform format for every case brief. Written in plain English, not in legalese. Our briefs summarize and simplify; they don’t just repeat the court’s language.