Calculating Federal Tax Liability

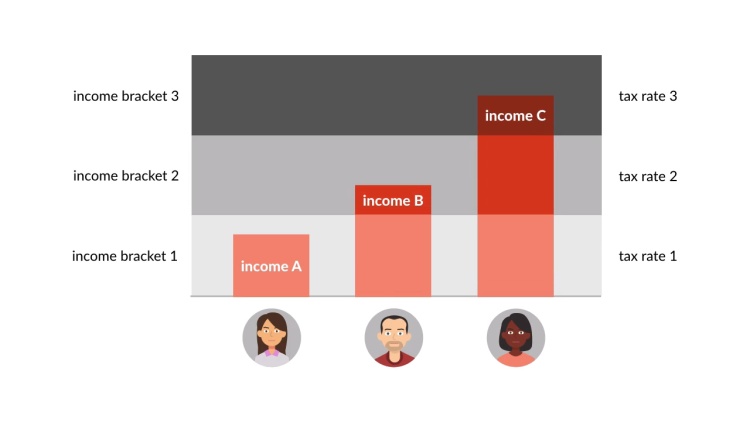

Learn how a taxpayer's federal tax liability is determined using gross income, adjusted gross income, exclusions, deductions, allowances, credits, and marginal tax rates.

Transcript

In this lesson, we'll survey the basic process to calculate federal income-tax liability for an individual who lacks capital gains and isn't subject to the alternative minimum tax. Along the way, we'll introduce ourselves to some key concepts we'll be revisiting throughout this course.

Calculate Gross Income

The first step is determining the taxpayer's gross income, because only gross income is potentially subject to federal income taxation. See 26 U.S.C. § 63(a). The Internal Revenue Code,...