Like-Kind Exchanges

Learn about the tax treatment of special transactions in which specified real property is exchanged for other, similar real property.

Transcript

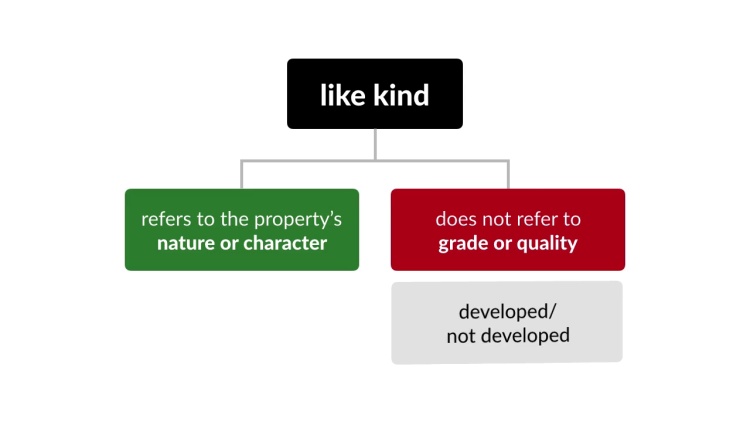

In this lesson, we'll cover the nonrecognition of gains and losses on like-kind exchanges under Section 1031 of the Internal Revenue Code, or IRC.

Introduction to Like-Kind Exchanges

As we've learned, a taxpayer's gain or loss on the sale, exchange, or other disposition of property is the difference between the taxpayer's adjusted basis in the property and the amount realized on the disposition. In general, any gain or loss on the sale, exchange, or other disposition of property must be...