Special Rules for Adjusted Basis

Learn how adjusted basis is determined in specific situations, including gifts, bequests, and transfers in satisfaction of obligations.

Transcript

We've learned that gain or loss on a sale or other disposition of property is typically the difference between amount realized and adjusted basis. We’ve also learned some general rules to determine adjusted basis. In this lesson, we'll learn some special basis rules that apply in specific situations.

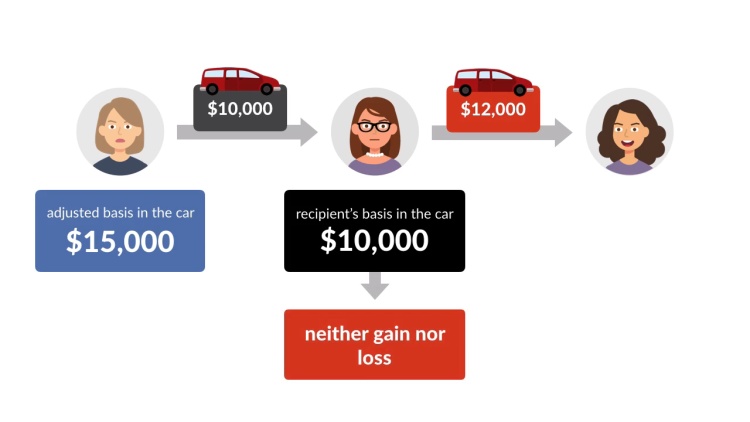

Basis in Property Received by Gift

First, let's examine a recipient’s basis in property received as an inter vivos gift. Inter vivos describes a gift from a living donor. See inter vivos gift,...