Home Ownership in the Federal Tax System

Learn about the most important tax consequences of home ownership, including the deduction for qualified residence interest and the exclusion of gain from the sale of a principal residence.

Transcript

In this lesson, we'll discuss two significant federal-tax ramifications of home ownership. They are

· the deduction for qualified-residence interest, and

· the exclusion of gain on the sale or exchange of a principal residence.

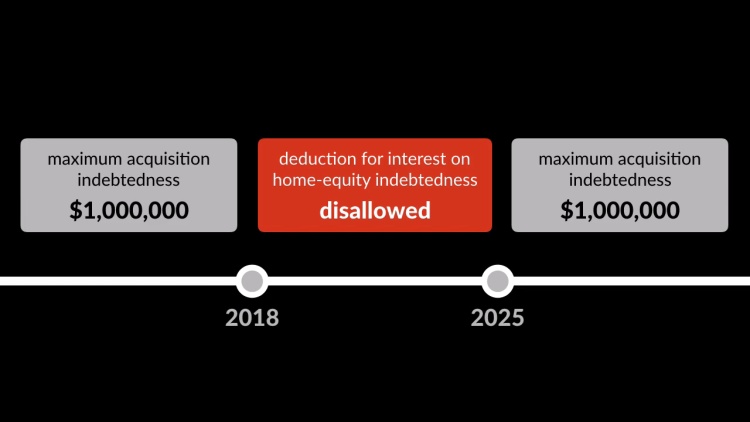

Deduction for Qualified-Residence Interest

We'll start with the deduction for qualified-residence interest. In a taxable year, a taxpayer can have two qualified residences, namely

·...