Depreciation Recapture

Learn how the depreciation-recapture rules affect the characterization of gains on the sale or exchange of depreciated property.

Transcript

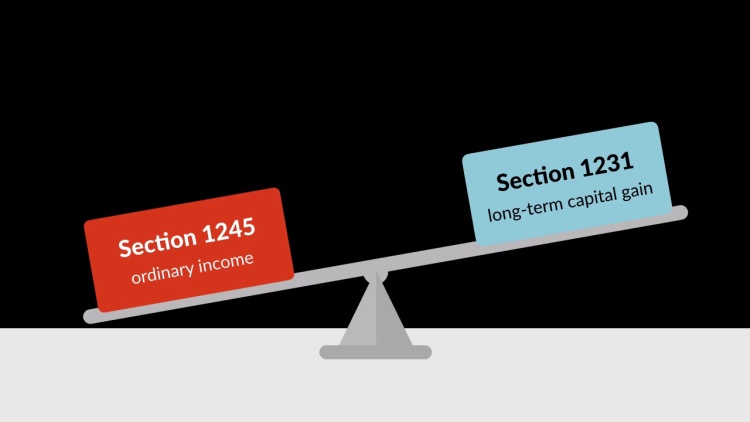

In this lesson, we'll talk about the depreciation-recapture rules under Section 1245 of the Internal Revenue Code, or IRC.

Introduction to Depreciation Recapture

The purpose of depreciation recapture is to create symmetry between the character of depreciation deductions and the character of realized gain that's ultimately attributable to those deductions. See 4 Mertens Law of Fed. Income Tax'n § 22:22, Westlaw (database updated Mar. 2019). As we've learned, the IRC permits taxpayers to deduct...