The Tax-Benefit Rule

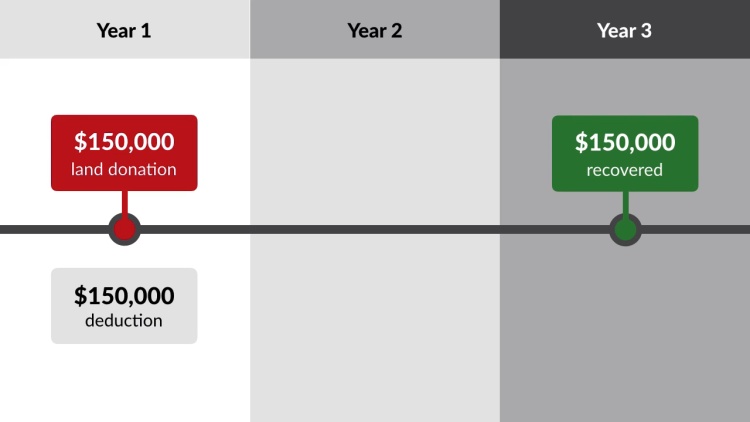

Learn about the rule that if a taxpayer recovers an expense item previously deducted, that amount may be includable in a later year's gross income.

Transcript

Introduction, General Rules

In this lesson, we'll study the tax-benefit rule. As we've learned, the federal income-tax system operates on annual accounting. Generally, each taxable year stands by itself. A taxpayer's liability for one taxable year is computed based on income and expenditures for that year. Events in prior years are generally disregarded.

Unbending adherence to pure annual accounting would produce lots of distortions and inequities. Thus, Congress and the courts have devised...