Involuntary Conversions

Learn about the rules in situations in which a taxpayer's property is destroyed, stolen, seized, or condemned, and the taxpayer receives compensation in exchange.

Transcript

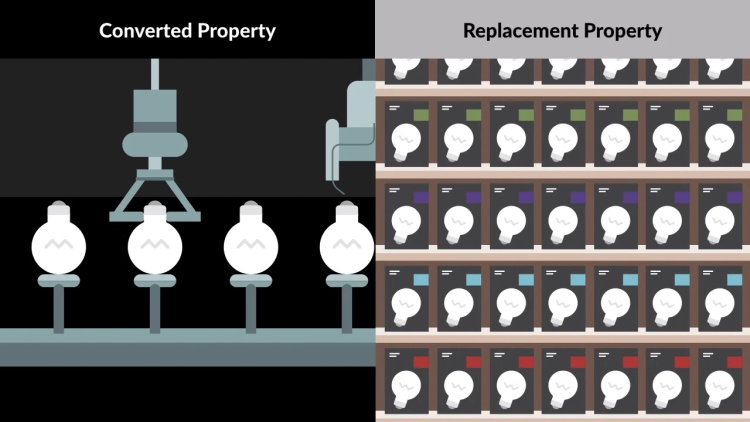

In this lesson, we'll explore the federal-tax consequences of the involuntary conversion of property into money under Section 1033(a)(2) of the Internal Revenue Code, or IRC.

Introduction to Involuntary Conversions

We're acquainted with the general rule that gain on the sale or other disposition of property equals the amount realized minus the taxpayer's adjusted basis in the property. Generally, this gain must be recognized, which means taken into account in computing federal-tax liability....